Layoffs in 2025 Drive Surge in Demand for Bad Credit Personal Loans Across the U.S.

With layoffs at their highest level since 2020, more Americans are searching for bad credit personal loans, emergency personal loans, and installment loan options. Loan-matching platforms such as Super Personal Finder are positioned within this trend as households look for fast approval and flexible repayment choices in 2025.

Dallas, Aug. 18, 2025 (GLOBE NEWSWIRE) -- This release is for informational purposes only and is not financial advice or a solicitation to lend. Super Personal Finder is not a lender, does not make credit decisions, and does not guarantee approval, loan amount, or funding speed. Loan terms, APR ranges, and availability vary by state and applicant profile, and not all borrowers will qualify.

Some links may be promotional. The publisher or author may receive compensation if an application is completed through them. This does not affect the rates, terms, or products offered. Borrowing involves costs and risks. Consumers should compare options, review all terms, and consult independent financial guidance before making decisions.

Layoffs in 2025 Drive Surge in Demand for Bad Credit Personal Loans Across the U.S.

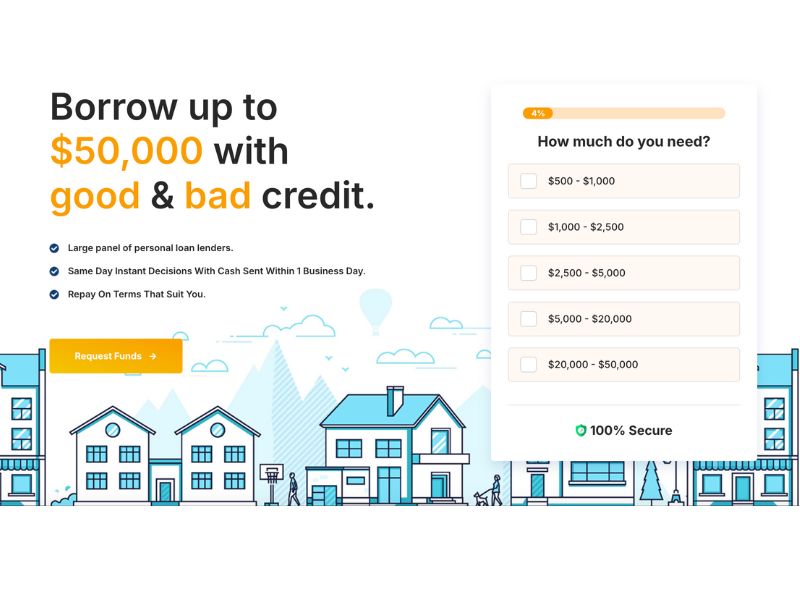

Economic uncertainty in 2025 has forced millions of Americans to reconsider how they access credit. With layoffs reaching their highest level since 2020, families across the country are searching for financial relief in the form of bad credit personal loans, emergency personal loans, and installment loan options. Federal cuts through the Department of Government Efficiency, combined with rising tariffs and inflation pressures, are leaving households with reduced income and limited access to traditional bank lending. This surge in demand is drawing attention to loan-matching platforms such as Super Personal Finder, which provides access to lenders offering loans up to $50,000 with flexible terms.

Explore personal loan opportunities today with Super Personal Finder and learn more about fast funding options designed for borrowers with both good and bad credit.

Why Interest in Bad Credit Personal Loans Is Surging in 2025

The financial reality of 2025 is reshaping how Americans think about credit and lending. Recent CBS News data revealed that more than 740,000 layoffs have already been announced this year, marking the steepest employment drop since the early months of 2020. Much of this disruption has been linked to federal workforce reductions under the Department of Government Efficiency, along with tariff-driven business strain that has placed new stress on entire industries. As employers reduce payrolls, families who once relied on steady income are facing sudden financial gaps.

When traditional paychecks disappear, the next challenge comes from credit scores. Missed payments, late bills, and reduced income often drive credit ratings lower, making it difficult for consumers to access bank loans or standard lines of credit. This cycle explains why searches for “bad credit personal loans” and “personal loans after layoffs” have surged across Google Trends in 2025. The interest is not abstract — it reflects real households confronting rent, utility bills, and unexpected expenses without the financial cushion they once had.

Bad credit personal loans are not new, but what is new is the volume of Americans now exploring them. Online search data, combined with social discussion on Reddit, TikTok, and consumer forums, shows a dramatic rise in people seeking fast approval loans with less focus on credit history. While some pursue payday alternatives, many are seeking installment loans that can spread repayment over months or years. This flexibility is especially critical in an environment where reemployment may take longer than expected.

Another factor behind the surge is the perception of speed. Traditional banks are seen as slow-moving and risk-averse, especially when evaluating applicants with lower credit scores. In contrast, online loan-matching services allow borrowers to submit a single request form and receive almost instant decisions. While not all requests are approved, the efficiency of the process attracts borrowers who value time as much as they value access.

For borrowers searching online, phrases such as “emergency personal loans USA” and “fast loan approval for bad credit” are increasingly common. These keywords reflect both urgency and frustration. People are not simply looking for credit in general — they are searching for targeted solutions that respond to immediate hardship. That is why 2025 is shaping up to be one of the most active years on record for alternative lending.

Consumers exploring loan options are also weighing the risks more carefully. The public conversation acknowledges that interest rates for bad credit loans can be higher, with APRs ranging widely depending on the lender. Yet the demand persists because access is often the first priority when families need funds for essentials.

Borrowers who want to compare their options in one place are turning to loan-matching platforms. These services provide access to a wide panel of lenders, giving applicants a chance to see multiple possibilities without filling out separate applications. One such service is Super Personal Finder, a platform that connects users to lenders offering personal loans up to $50,000.

How Super Personal Finder Works

Super Personal Finder is structured to meet one of the most pressing needs of 2025: access to multiple lending options in one place. Rather than serving as a direct lender, the platform operates as a loan-matching service. That distinction matters. It means consumers are not applying for a loan with Super Personal Finder itself, but instead using a single request form that is shared across a large panel of lenders. This approach streamlines the borrowing process while giving applicants a broader chance of finding a loan that fits their situation.

The process begins with a simple online form. Applicants indicate how much they are hoping to borrow, with amounts ranging from as little as $500 up to $50,000. This wide loan range is one of the reasons Super Personal Finder has gained attention, as it covers everything from urgent household needs to larger financial goals such as debt consolidation. Once the form is completed, the platform’s software matches the request against its network of lenders. The decision process is almost instant, allowing users to see potential loan opportunities without waiting days or weeks for traditional bank underwriting.

For many borrowers, the appeal lies in the speed and convenience. If a lender approves the request, funds are typically transferred via electronic deposit within the next business day. This quick turnaround is critical in 2025, when layoffs and income cuts leave families with immediate expenses. While no service can guarantee approval, the ability to connect with multiple lenders at once increases the likelihood of finding a viable match.

Super Personal Finder also emphasizes flexibility. Repayment terms vary by lender, but installment structures allow consumers to spread payments over several months or years. This is particularly important for borrowers dealing with reduced income, as it avoids the cycle of short-term advances that can be difficult to manage. APR ranges, provided by lenders in the network, typically fall between 5.99 percent and 35.99 percent, depending on credit history and loan size.

Another advantage is transparency. The platform makes it clear that it does not charge consumers for using the service. Instead, lenders and lending partners may compensate the platform if they extend an offer through the system. That business model ensures borrowers can explore loan options without upfront fees or hidden costs.

For consumers facing financial hardship, this loan-matching approach represents efficiency and choice at a time when both are in short supply.

Explore your options today through this Super Personal Finder link and compare personal loan offers from a wide lender network.

Loan Categories Consumers Are Seeking in 2025

The surge in personal loan demand during 2025 is not random. Borrowers are clustering around three major categories that directly reflect the financial pressures of layoffs, inflation, and tightening credit standards. These categories are emergency personal loans, installment loans, and no credit check loans. Each serves a distinct purpose in the marketplace, but together they explain why so many Americans are turning to alternative lending platforms.

Emergency personal loans are designed for immediate needs. When a family member loses a job, rent and utility bills cannot wait for traditional bank processing. Emergency loans are typically smaller in size, often in the $500 to $5,000 range, but their speed of approval makes them attractive to households facing sudden expenses. Online discussions in 2025 show rising searches for “emergency personal loans USA” as workers seek fast solutions during periods of instability.

Installment loans are gaining attention for a different reason. Rather than focusing only on speed, these loans emphasize repayment flexibility. Borrowers can spread payments over months or years, reducing the pressure of making large lump-sum repayments. For consumers impacted by layoffs, installment structures provide breathing room and a sense of control over finances. Searches for “installment loans 2025” and “monthly repayment loan options” are climbing across Google Trends, reflecting a growing demand for predictability.

No credit check loans round out the category surge. These options attract borrowers who have seen their credit scores fall due to missed payments or income loss. While rates are often higher, the appeal lies in access rather than perfection. Borrowers are signaling that they understand the trade-offs but prioritize the ability to secure cash when traditional banks deny applications. Online forums confirm this trend, with posts discussing how “no credit check loans after layoffs” are becoming more common queries in 2025.

Super Personal Finder fits within this demand pattern by providing access to all three categories through its loan-matching platform. By submitting a single request, borrowers can be considered for emergency personal loans, installment loans, or lenders offering reduced emphasis on credit history. This range is valuable for households facing unique financial challenges, since every borrower’s needs differ.

Consumers interested in reviewing multiple loan categories in one place can request funds directly through Super Personal Finder’s loan-matching platform. The service allows applicants to explore personal loan opportunities across a wide lender panel without completing multiple applications.

Transparency And Eligibility

As demand for personal loans increases in 2025, transparency has become one of the most important issues for borrowers. Consumers are aware of the risks that come with borrowing, especially when credit scores are low or income has been disrupted by layoffs. That is why platforms like Super Personal Finder emphasize clear eligibility details, representative examples, and open disclosure of limitations. This clarity not only helps borrowers make informed choices but also keeps the service aligned with regulatory and editorial standards.

One of the most frequently asked questions from borrowers is about interest rates and repayment terms. Within the Super Personal Finder network, APRs generally range from 5.99 percent to 35.99 percent depending on the lender, the applicant’s credit profile, and the size of the loan. A representative example shows that if a borrower secured a $5,000 installment loan over 48 months with an 8 percent arrangement fee, monthly repayments could be around $131, with a total repayment of over $6,300. While these numbers vary across lenders, providing them up front ensures borrowers know that interest and fees are part of the overall cost.

Eligibility also depends on geography. Not every loan provider operates in every state. Super Personal Finder discloses that its service is unavailable in Arkansas, Connecticut, New Hampshire, New York, Montana, South Dakota, Vermont, West Virginia, Indiana, and Minnesota. This is due to differences in state regulations and lender preferences. By clarifying availability in advance, the platform avoids misleading applicants and ensures only eligible consumers proceed with loan requests.

Another area of importance is credit checks. Some lenders perform full credit reviews through major bureaus such as Experian, Equifax, or TransUnion, while others rely on alternative checks or consumer reports. Borrowers should be aware that submitting a request does not guarantee approval, nor does it lock in specific loan terms. Instead, the process authorizes lenders in the network to evaluate the information provided and determine eligibility based on their criteria. This ensures lenders retain control over final decisions, while borrowers gain access to a wider panel of potential matches.

Transparency also extends to the platform’s business model. Super Personal Finder does not charge consumers to use the service. Instead, lenders or lending partners may compensate the platform if they extend a loan offer. This arrangement means applicants can submit requests without upfront costs or hidden fees.

Consumers seeking clarity on eligibility, interest rates, and state access can learn more or begin their request through Super Personal Finder. The platform positions itself as a straightforward resource for borrowers navigating one of the most uncertain financial years in recent memory.

Public Conversations Around Job Loss And Loan Access

The story of layoffs and lending in 2025 is not only written in financial data but also reflected in the conversations taking place online. Social platforms have become windows into how ordinary people are coping with sudden job loss, reduced income, and limited access to traditional credit. These discussions show why personal loans tied to layoffs are becoming one of the most visible financial topics in the United States.

On Reddit forums, users describe how losing a job changes everything from paying for groceries to covering rent. Posts often discuss “personal loans after layoffs” or “emergency loans with bad credit” as survival strategies when traditional banks say no. The tone in these conversations is pragmatic, not promotional. People are seeking information, sharing experiences, and debating whether installment loans are a responsible way to stabilize finances in uncertain times.

TikTok creators are also playing a role in shaping the public narrative. Short-form videos explaining the difference between installment loans and payday advances are reaching millions of views. Viewers are engaging with content tagged around “fast loan approval USA” and “no credit check loan stories.” While some creators warn about high interest rates, others frame personal loans as a temporary tool for getting through layoffs. The variety of voices underscores how mainstream the topic has become in 2025.

Podcasts and YouTube panels add another layer, with experts and consumers discussing broader economic shifts. Tariffs and inflation pressures are mentioned alongside layoffs, connecting the dots between macroeconomic factors and household-level credit demand. Episodes often emphasize that while banks remain cautious, alternative lending platforms are filling the gap. This framing highlights why personal loan matching services are gaining traction as neutral access points to multiple lenders.

The public conversation is not one-sided. Critics raise concerns about debt cycles, repayment challenges, and predatory lending. Supporters argue that access matters most in times of crisis and that borrowers should have choices, even if the options carry higher rates. Neutral observers suggest that the very popularity of bad credit personal loans in 2025 signals deeper issues with financial resilience across households.

For consumers who want to compare options without committing to a single lender, platforms such as Super Personal Finder provide a way to see multiple possibilities through one request form. This positions loan matching as part of the broader public discussion — not as a guarantee, but as a resource at a moment when millions of Americans are searching for answers.

Market Reflections — Why Alternative Lending Is Expanding

The lending market of 2025 looks very different from just a few years ago. Layoffs tied to federal workforce reductions, tariff-driven industry challenges, and inflationary pressure on household budgets have created a financial climate where alternative lending is no longer viewed as secondary. It has become a primary path for millions of borrowers who cannot secure loans through banks or traditional credit unions.

One of the clearest indicators of this shift is the rise in search activity. Google Trends data shows record highs for phrases such as “bad credit personal loans 2025,” “installment loans after layoffs,” and “emergency cash loan options.” These spikes in search volume are direct signals of consumer demand. People are not simply curious; they are actively searching for financing solutions that meet immediate needs. Alternative lending platforms are capturing this demand by offering quick responses, broader lender access, and more flexible terms than many banks are willing to provide.

The expansion of loan matching services is also linked to how banks have tightened their risk standards. In a climate where income instability is widespread, traditional institutions are cautious about extending credit to borrowers with poor or moderate credit scores. This has created what economists describe as a “credit access gap.” Families who once could secure short-term personal loans through their bank are now finding those options closed. Into that gap step services like Super Personal Finder, which connect borrowers to multiple lenders through one streamlined process.

Another driver of expansion is the broader economic conversation around tariffs and inflation. Tariff policies have increased costs across supply chains, placing pressure on companies and workers alike. Rising consumer prices have strained budgets, leading to more late payments and damaged credit profiles. When these factors combine with layoffs, the outcome is a historic wave of demand for loans that bypass traditional gatekeepers. The growth of alternative lending is not just a business trend; it is a reflection of macroeconomic forces reshaping household finance.

Critics of the trend argue that high APRs, which can range from 5.99 percent to 35.99 percent across different lenders, may deepen financial strain for already vulnerable borrowers. But supporters point out that access is often more important than perfect rates, particularly during moments of crisis. For many, the alternative is not a lower-interest bank loan — it is no loan at all. That distinction explains why loan matching platforms are experiencing unprecedented traffic in 2025.

As more consumers seek options, transparency and flexibility are becoming the defining features of the market. Loan matching platforms offer visibility into multiple categories — emergency loans, installment loans, and no credit check loans — giving borrowers the ability to compare and make informed decisions. This model positions services like Super Personal Finder at the center of an expanding category that reflects the realities of today’s financial environment.

The Debate Around Bad Credit Lending — Supporters And Skeptics

The surge in demand for bad credit personal loans in 2025 has created a strong public debate. Supporters highlight the role these loans play in providing access during moments of financial instability, while skeptics question whether high interest rates and repayment challenges may worsen household debt. Both perspectives are shaping how consumers, economists, and policymakers view the personal loan market this year.

Supporters of bad credit lending argue that access is the foundation of financial survival. For families facing layoffs, job cuts, or unexpected expenses, the alternative to securing a personal loan is often defaulting on rent, utilities, or medical bills. In these situations, bad credit loans provide an opportunity to bridge the gap until income returns. Advocates point out that APRs ranging between 5.99 percent and 35.99 percent may sound high in theory, but in practice they are often the only option available to borrowers who cannot pass a traditional credit check. The choice, they say, is not between a low-interest loan and a higher-interest loan — it is between access and no access at all.

Skeptics raise a different concern. They worry that borrowers under stress may take on loan terms they cannot realistically repay. This can create a cycle of late fees, refinancing, and growing debt that deepens financial hardship rather than resolving it. Critics also note that some borrowers may misunderstand repayment schedules, especially when loans are marketed as fast and easy solutions. These voices call for stronger education around loan terms and for consumers to compare multiple offers before committing.

Neutral observers provide a more balanced perspective. They note that the popularity of bad credit personal loans is a symptom of deeper structural issues, such as wage stagnation, lack of savings, and systemic barriers to traditional credit access. From this view, the debate is less about whether bad credit lending is “good” or “bad” and more about recognizing it as part of a financial landscape shaped by layoffs, tariffs, and inflation. The fact that millions are searching for “emergency personal loans after layoffs” or “no credit check loans 2025” shows that the demand is real and unlikely to disappear soon.

What unites all sides of the debate is the recognition that borrowers must proceed carefully. Transparency is essential, and loan matching platforms are playing a role by making clear that not all applicants will be approved, not all states are eligible, and APRs can vary significantly. This kind of disclosure allows consumers to make better decisions in a market where options are often limited.

Borrowers who want to weigh multiple offers without committing to a single lender can use services such as Super Personal Finder. The platform provides access to a broad panel of lenders, allowing applicants to see potential terms before deciding which path is right for them. While the debate continues, loan matching services remain one of the most visible ways Americans are responding to the financial challenges of 2025.

About Super Personal Finder

Super Personal Finder is a personal loan matching platform designed to connect borrowers with a wide panel of lenders across the United States. The platform does not operate as a direct lender. Instead, it functions as a referral service that allows applicants to submit one request form which is then evaluated by multiple lending partners. This process saves time and creates more opportunities for approval compared to applying with individual lenders one by one.

The service supports loan amounts ranging from $500 to $50,000, making it relevant for both small emergency expenses and larger financial needs such as debt consolidation. By covering borrowers with both good and bad credit, Super Personal Finder has positioned itself as a flexible option in an environment where access to traditional credit is often restricted.

Speed is another defining feature. Applicants receive almost instant decisions after submitting a request, and when approved by a lender, funds are typically deposited via electronic transfer within the next business day. Repayment terms vary, but installment structures allow for flexible scheduling that aligns better with reduced or unpredictable income.

Transparency is central to the platform’s model. Super Personal Finder does not charge consumers for submitting a request. Instead, lenders or marketing partners may compensate the service if a loan offer is made through its network. This ensures that applicants are not paying hidden fees simply for exploring their options.

For borrowers facing the financial challenges of layoffs, tariffs, or inflation-driven cost increases, Super Personal Finder provides a straightforward way to review loan possibilities in one place.

Request funds and review loan options today at Super Personal Finder.

Contact

- Company: Super Personal Finder

- Email: support@superpersonalfinder.com

- Website: Super Personal Finder

Final Disclaimer

This press release is for informational purposes only. The information contained herein does not constitute financial advice, lending approval, or a solicitation to lend. Super Personal Finder is not a lender, does not make loan or credit decisions, and does not guarantee loan approval. The service connects consumers with a panel of lenders who determine eligibility and loan terms independently.

Loan availability varies by state. The service is not available in Arkansas, Connecticut, New Hampshire, New York, Montana, South Dakota, Vermont, West Virginia, Indiana, or Minnesota. APR ranges, repayment terms, and loan amounts depend on the lender and applicant qualifications. A representative APR may range between 5.99 percent and 35.99 percent, but rates that low are not available to all borrowers.

Consumers should carefully review all loan offers, terms, and conditions before making a decision. Submitting a request form does not guarantee approval, loan amount, or funding timeline. Loan terms are provided by lenders, not by Super Personal Finder.

Some links in this release may be promotional in nature. The publisher or author may receive compensation through affiliate commissions if a loan application is completed through the provided links. This compensation does not affect the price or loan terms offered to consumers.

Borrowers are encouraged to consult independent financial guidance when considering personal loans. Taking on debt carries risks and may not be appropriate for every situation. Always compare multiple options and make informed decisions based on your personal financial circumstances.

Email: support@superpersonalfinder.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.